OneSumX for Basel IV

Extract Business Value from Basel IV

Drive business projection scenarios and deal-related decision-making

Learn moreBasel IV — Drive a Consolidated Group Approach

Manage Basel IV compliance for the entire group

Learn more

OneSumX

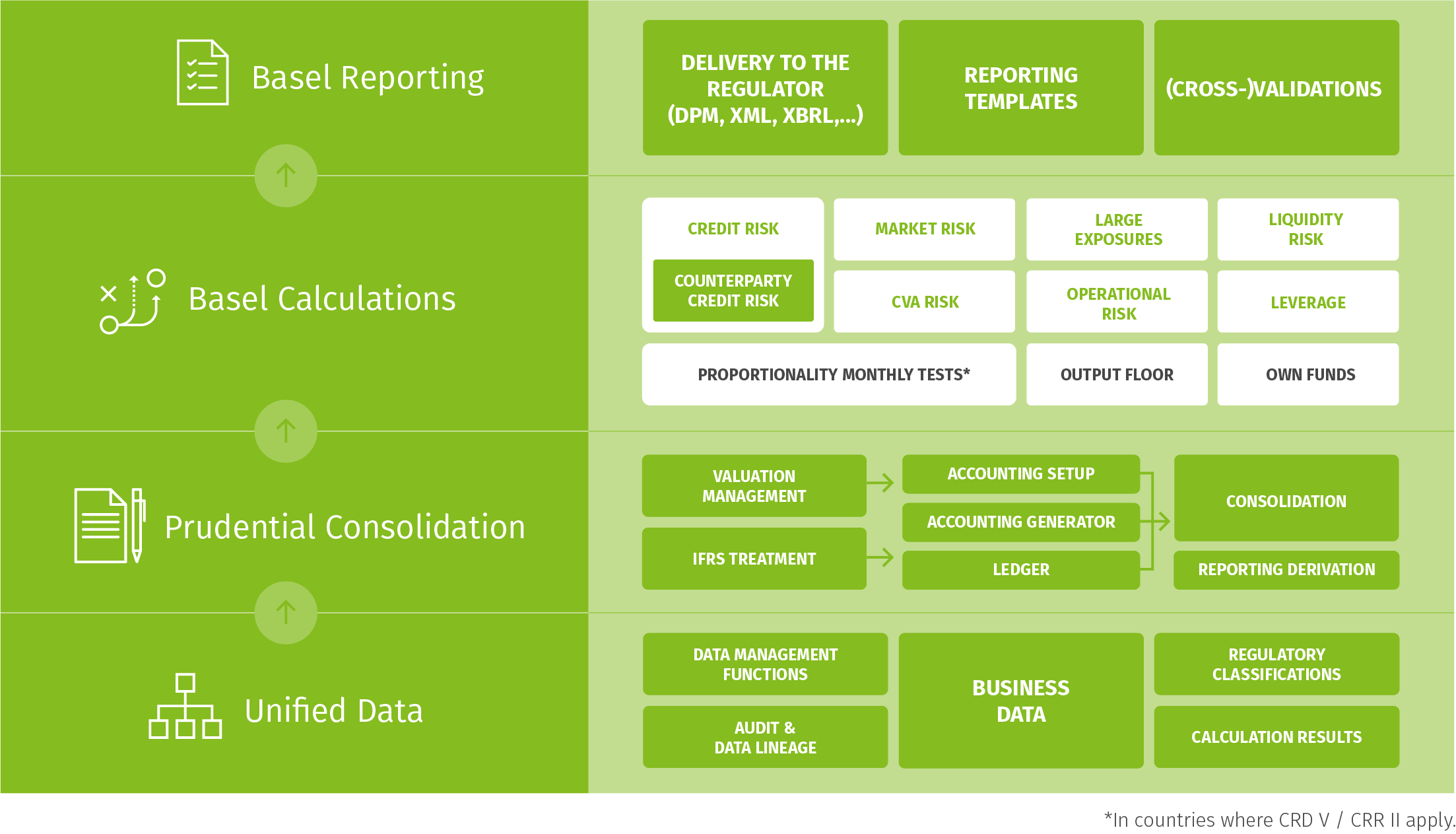

Deliver a holistic approach to Basel IV

A modular solution that combines data, calculations and reporting can make a tangible difference in efficiency and effectiveness. This is especially true if your solution covers advanced approaches across all bank sizes and risk types, from credit to market risk, through operational, settlement, counterparty valuation adjustment, and counterparty credit risk.

Whether you want to comply with an immediate regulatory requirement or benefit from a regulatory compliance solution that can help you run your business more effectively, the OneSumX for Finance, Risk & Regulatory Reporting suite can help.

Basel IV For Compliance

Consensus is in! Find out what the biggest challenge firms expect to face to remain Basel IV compliant. Read our commentary to find out.

CRD V / Basel IV is the perfect storm. But how you weather the storm will depend on your choices. Download our new commentary to learn more.

How can our OneSumX for Finance, Risk & Reporting solution portfolio help you with your Basel IV needs? Discover all the benefits at your fingertips by watching our video series with Xavier Dubois.

Contact UsBenefits

Maintain a Strategic Approach During Regulatory Uncertainty

Compliance at any time and reduce the time to report to the regulator

Improve quality and consistency of complex processes

Minimize the cost of managing ever-changing regulation

OneSumX

Extract Business Value from Basel IV

Is Basel IV The Opportunity To Start Projecting Exact Regulatory Metrics?

Optimization

Optimize your business strategy by factoring in both the business and regulatory impact of Basel IV

Exact Regulatory Metrics

Ensure a more accurate picture of your business by using exact regulatory metrics rather than proxies

Risk Management

Leverage regulatory metrics projections for operational risk management, stress testing and much more

Business & Strategy

Gain an accurate assessment of business continuity and adjust your strategy accordingly

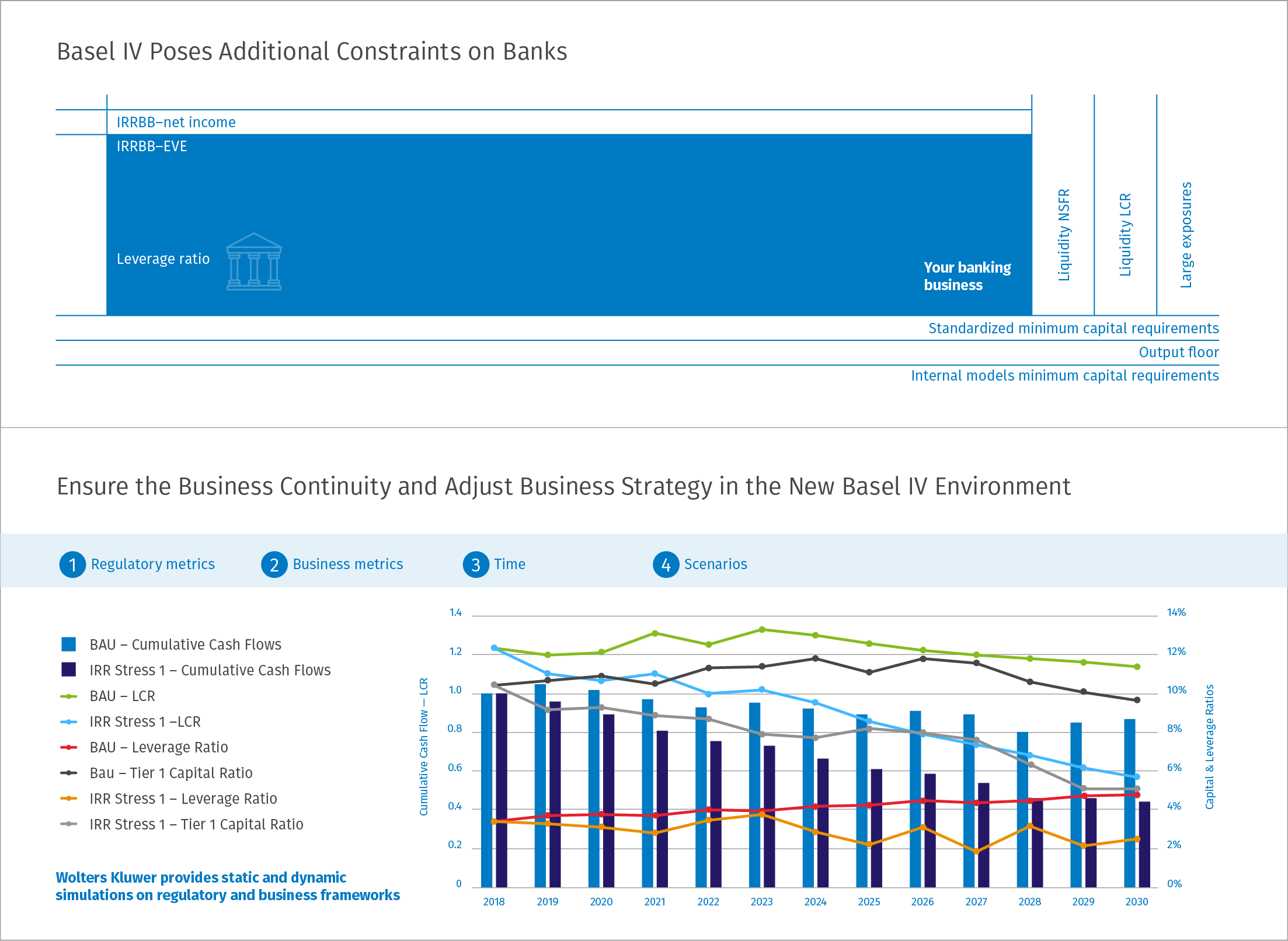

Calculating regulatory metrics (i.e. RWA, LCR) is an inevitable part of the Basel IV compliance. However, could required regulatory metrics — measured along future scenarios — help inform more strategic business decision-making?

As you confront compliance challenges, don’t forget to prepare for the opportunities the new Basel framework offers. Read our whitepaper, ‘Basel IV – Your Path to a More Profitable Business’ to learn more.

How to approach the Basel IV implementation to ensure short, mid and long-term benefits. Read the commentary to learn more.

A few practical considerations around SA-CCR solution implementations.

To discover how our OneSumX solution portfolio can help you with Basel IV compliance and beyond, watch the ‘Basel IV: regulatory uncertainty — an opportunity to prepare’ webinar recording.

Contact UsBenefits

Measure Regulatory Metrics Along Future Scenarios to Improve Decision-Making

Dynamic budgeting and stress testing tools

Risk optimization process across risk and regulatory requirements

Reliable data around investments and divestments

OneSumX for Basel IV

Drive a Consolidated Group Approach

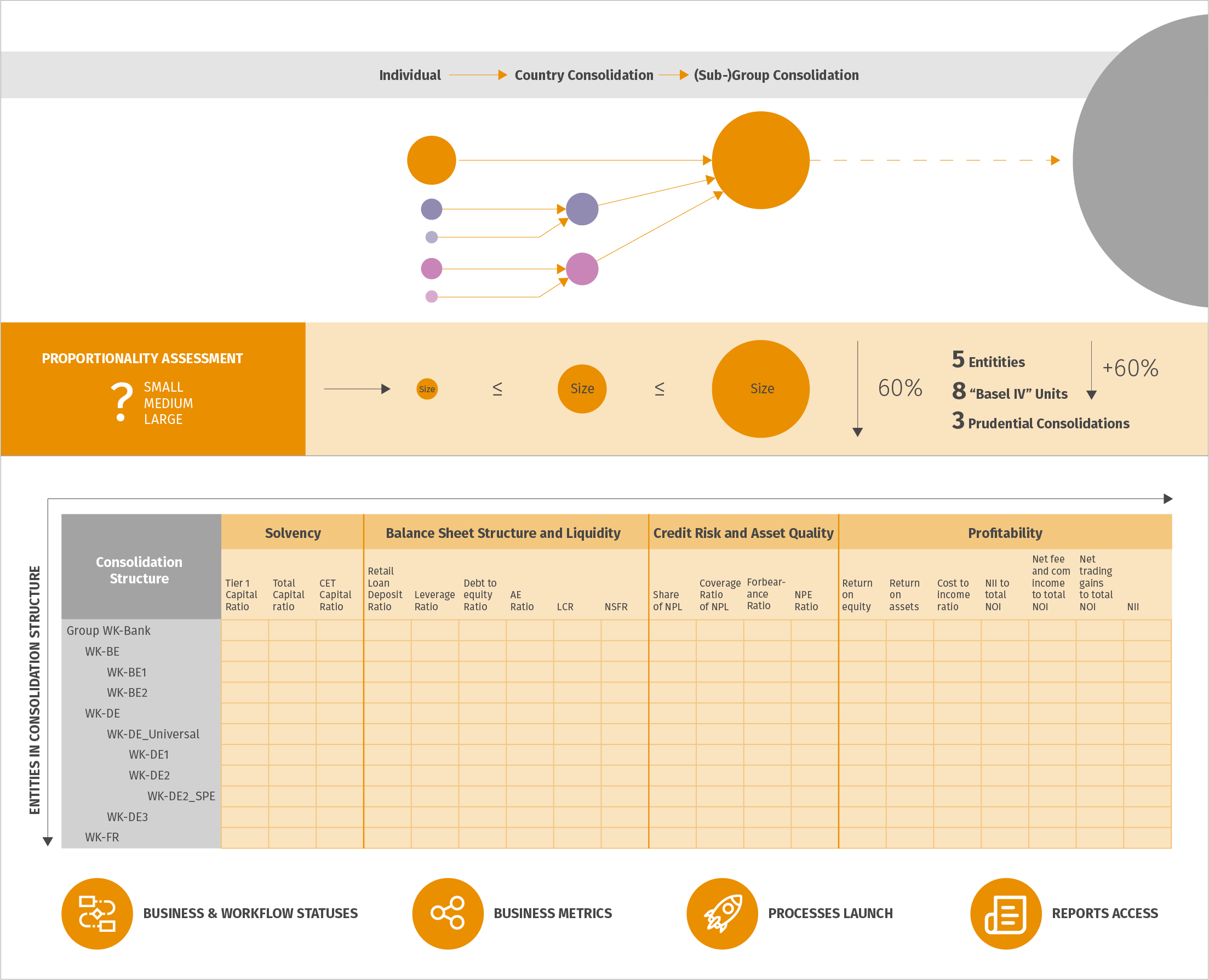

With Basel IV compliance for the entire group, data, prudential consolidation, regulatory calculations, and reporting, can be managed for each entity and consolidation circle from a single application.

Consolidation Under Basel IV For Groups

Want to uncover what steps are needed for the effective implementation of the standardized approach to market risk? Read our commentary to uncover the details.

This commentary is a follow-up that further explores the essential elements needed for an effective standardized approach to market risk. Read to find out more.

Whether you want to fix an immediate priority or benefit from a regulatory compliance solution that can help you run your business more effectively, the OneSumX for Finance, Risk & Regulatory Reporting suite can help.

Contact usBenefits

Effectively Apply Consolidation to Different use Case Entities

Streamline finance and risk processes and browse decision-making across the reporting hierarchy

Enhance quality, consistency and control around consolidation requirements

Having control on the regulatory constraints across different hierarchies and reporting entities

Want to find out more?

Please get in touch and one of our specialists will assist you.

** Please read the privacy policy. By checking the opt-in checkbox, you are agreeing to receive occasional communications about Wolters Kluwer Financial Services resources, events, products, or services. You also acknowledge that you have read and understood our Privacy Policy.

For managing your subscription please use the preference center.

touch

to top